MoneyTree Partners Transform struggles — into success with quality strategy.

MoneyTree Partners

Geopolitical Risk and Mutual Funds: What Trump’s Actions Mean for Indian Investors

Global investing in the present day is influenced by more than just earnings, interest rates, or economic growth. Political events, particularly from the world’s largest economy, significantly impact market sentiment. Donald Trump’s policy stances, public remarks, and erratic behavior have consistently provoked strong reactions in global markets. For Indian mutual…

NRI Taxation Updates 2026: What Every NRI Must Know Before Investing in India

As India continues to remain one of the most attractive investment destinations for Non-Resident Indians (NRIs), understanding the latest NRI taxation rules in 2026 has become more important than ever. While investment opportunities in India—such as mutual funds, SIPs, real estate, and insurance—offer strong long-term potential, taxation, FEMA compliance, and…

How to Build a ₹1 Crore Corpus with SIP: A Step-by-Step Guide

Creating a ₹1 crore corpus is not solely a goal for affluent investors. Through the advantages of SIP (Systematic Investment Plan) and the effects of compounding, even modest and regular contributions can accumulate into a substantial sum over time. In India, SIPs have emerged as the most dependable and disciplined…

5 Best Habits of Successful Long-Term Investors in India

How to Accumulate Wealth Gradually, Steadily, and Intelligently In India, an increasing number of individuals are recognizing the advantages of long-term investment strategies. As financial literacy rises, the appeal of mutual funds, SIPs (Systematic Investment Plans), and equity investments has surged significantly. However, despite the ease of access to the…

Trump’s 50% Tariffs on India: What It Means for Mutual Fund Investors

In an unexpected development in August 2025, U.S. President Donald Trump imposed a 50% tariff on a broad range of Indian imports—double the previous rate—focusing on commodities such as textiles, gems, auto parts, and others. This action, widely interpreted as a reaction to India’s ongoing acquisition of Russian oil, has…

How to Start a SIP Step-by-Step: A Simple Guide for Beginners

Investing in mutual funds via Systematic Investment Plans (SIPs) is among the most favored and effective methods for accumulating long-term wealth. SIPs enable investors to contribute a predetermined amount consistently — either monthly or quarterly — into mutual funds, fostering a disciplined saving routine while reaping the benefits of market…

How to Choose the Right Mutual Fund Distributor in India

As mutual funds gain popularity as a preferred investment choice in India, an increasing number of investors are seeking professional assistance to manage their portfolios. Whether you are a novice investor or someone aiming to broaden your financial strategy, selecting the appropriate mutual fund distributor is a vital choice. The…

Iran-Israel War: What It Means for Indian Stock Markets and Mutual Fund Investors

Recently, tensions between Iran and Israel have intensified, raising significant concerns not only regarding geopolitics but also concerning global economies and financial markets. For Indian investors, particularly those involved in mutual funds, it is crucial to comprehend how such international disputes can affect stock markets in India, and what actions…

Jio Finance & BlackRock Join Hands: A New Era for Indian Mutual Fund Investors

India’s financial sector is experiencing a transformative partnership that has the potential to change the way millions of Indians invest. Two influential entities — Jio Financial Services (part of the Reliance Group) and BlackRock, the largest asset management firm globally — have joined forces to establish a new mutual fund…

NPS vs UPS: Which Pension Scheme Is Better for You?

Planning for retirement is crucial for everyone. If you are a government employee or someone considering a long-term pension plan, you may have come across the NPS (National Pension Scheme) and the recently launched UPS (Unified Pension Scheme). Both schemes are designed to offer financial assistance during retirement, yet they…

Why SEBI’s Nominee Rule Is a Game-Changer for Mutual Fund Investors

If you have invested in mutual funds in India or are considering doing so, it is essential that you pay attention to this new SEBI regulation. The Securities and Exchange Board of India (SEBI) has implemented a significant modification concerning nominations in mutual fund folios. This new regulation is designed…

How NRIs Can Avoid Taxes on Mutual Fund Gains

Mutual funds have emerged as one of the most favored investment approaches for Indians, including Non-Resident Indians (NRIs). However, a common inquiry among NRIs is: “Am I required to pay tax on mutual fund returns in India?” The response is not always favourable. In fact, certain NRIs are not obligated…

Will Mutual Funds Outperform the Indian Stock Market in 2025?

Mutual funds have become one of the most popular investment options for Indian investors. With growing awareness, more and more people are investing in SIPs (Systematic Investment Plans) and diversified mutual fund portfolios. But the big question for 2025 is: Will mutual funds outperform the Indian stock market this year?…

WHY SIF LAUNCH CAN BE UPI MOMENT FOR MUTUAL FUND INDUSTRY

The Indian financial world is buzzing with a new development – the launch of Specialised Investment Funds (SIFs). Many experts are saying this could be a “UPI moment” for the mutual fund industry. But what does that really mean? Let’s break it down in simple terms and understand why this…

Understanding the UAE Shift: Nilesh Shah of Kotak AMC Discusses Tax Loopholes Exploited by NRIs

In April 2025, Nilesh Shah, the Managing Director of Kotak Mahindra Asset Management Company (AMC), raised awareness about a tax loophole that enables Non-Resident Indians (NRIs) to legally evade capital gains tax in India by temporarily relocating their tax residency to nations such as the United Arab Emirates (UAE). Although…

How can Mutual Fund help you achieve FIRE (Financial Independence Retire Early)

The FIRE (Financial Independence, Retire Early) movement encourages individuals to save and invest diligently with the goal of retiring significantly earlier than the conventional retirement age. Achieving FIRE hinges on astute investment strategies, and mutual funds are among the most effective means to enhance your financial growth. Understanding FIRE FIRE…

How to pick the best mutual fund for your goals?

Mutual funds represent one of the most effective methods for accumulating wealth over time. They provide a straightforward and efficient means of investing in stocks, bonds, and various other assets without requiring extensive expertise. Nevertheless, the abundance of mutual funds available can make the selection process overwhelming. This guide aims…

The Importance of Fund Managers in Mutual Fund Performance.

Introduction Mutual funds have become one of the most popular investment options in India, offering a diversified portfolio with professional management. One of the key factors that determine the success of a mutual fund is its fund manager. A fund manager plays a crucial role in managing investors’ money, making…

** Mutual Fund Exit load and Lock – in Period Explained **

Investing in Mutual Funds is one of the most popular ways to grow wealth. It’s simple, flexible, and provides openings for long- term earnings. still, before investing, it’s important to understand crucial terms like ** exit Load** and ** lock- in period **. These terms affect how and when you…

The Future of Mutual Fund Investments in India: Trends and Opportunities

Mutual fund investments in India have seen significant growth in recent years. With increasing financial literacy, digital accessibility, and government support, more people are choosing mutual funds as their preferred investment option. The future of mutual funds in India looks promising, with several trends and opportunities shaping the market. In…

UNDERSTANDING MUTUAL FUNDS NAV: what investors need to know?

Investing in mutual funds is one of the most popular ways for Indians to grow their wealth over time. However, many investors have difficulty understanding the key terms associated with mutual funds. One such key term is Net Asset Value (NAV), and understanding NAV is essential to making informed investment…

The Impact of Inflation and Interest Rates on Mutual Funds

Mutual funds are one of the most popular investment options in India. They offer a convenient way for individuals to invest in a diversified portfolio of assets, including stocks, bonds, and other securities. However, like any investment, mutual funds are affected by various economic factors. Two critical factors that influence…

Debt Mutual Funds: Understanding the Post-Tax Rule Changes

Debt mutual funds have long been a general option among investors seeking low risk and stable profits. These funds are mainly invested in bonds tools such as government securities, corporate bonds, and money market instruments. However, the tax system has had a significant impact on its attractiveness, and recent changes…

Comparison of Mutual Funds with Other Investment Options

A crucial first step in reaching financial objectives and safeguarding your future is investing. Choosing where to invest your money might be difficult with so many possibilities available. Mutual funds are well-liked among these choices because of their expert management and variety. To appreciate their benefits and drawbacks, mutual funds…

Mutual Funds for Every Life Stage: A Guide for Indian Investors

Mutual Funds for Every Life Stage: A Guide for Indian Investors Investing in mutual budget may be a clever manner to develop your wealth over time. They are versatile, professionally managed, and cater to unique economic dreams and threat appetites. But did you realize that mutual fund also can align with the numerous tiers of your lifestyles? From beginning your profession to making plans for retirement, mutual fund can play a important position in securing your economic destiny. Here’s a manual tailor-made for Indian buyers to navigate mutual fund at each lifestyles level. 1. Early…

YEAR-END INVESTMENT STRATEGIES TO MAXIMIZE RETURNS

The end of the 12 months is a top notch time to review and adjust your investment strategies. For buyers in India, mutual funds are a fantastic choice to grow wealth systematically. With more than a few funds catering to distinct threat appetites and economic goals, mutual funds offer flexibility…

Mutual Funds for NRI: Rules and Regulations

Mutual funds are an excellent investment option for Non-Resident Indians (NRIs) who want to grow their wealth in India. They offer the advantage of professional management, diversification, and flexibility. However, there are specific rules and regulations that NRIs must follow when investing in mutual funds in India. This blog will…

THE ROLE OF MUTUAL FUND IN ACHIEVING FINANCIAL FREEDOM IN INDIA

Financial independence is a goal pursued by many individuals in India, as it allows for a lifestyle free from persistent financial anxiety. It entails having sufficient savings, investments, and income to meet one’s expenses and fulfill personal aspirations. For those in India aspiring to attain financial independence, mutual funds (MFs)…

Exploring Delhi’s Mutual Fund Landscape: Best Companies for SIP and Long-Term Investments

Investing in mutual funds through a Systematic Investment Plan (SIP) is a favored and effecient method to accumulate wealth over time. As the capital city of India, Delhi provides numerous choices for investors looking to make wise investment choices. In this article, we’ll look into Delhi’s mutual fund scene, pointing out some of the top companies for SIPs and long-term investments. Understanding Mutual Funds and SIPsBefore discussing the…

Best Mutual Fund Distributor in Delhi: Your Guide to Smart Investment with Money Tree Partners

In the dynamic financial landscape of India’s capital, finding the best mutual fund distributor inDelhi can significantly impact your investment success. Money Tree Partners has establisheditself as Delhi’s premier mutual fund distribution firm, offering expert guidance and personalizedsolutions to investors seeking to build wealth through mutual funds. Why Choose the…

Best Financial Planner in Delhi: Your Guideto Wealth Creation with Money TreePartners

When it comes to securing your financial future in India’s capital, choosing the best financialplanner in Delhi can make all the difference. Money Tree Partners has established itself asDelhi’s premier financial planning firm, offering comprehensive wealth management solutionstailored to your unique needs. Why Delhi Professionals Trust Money Tree Partners As…

Will India’s Unfair Market Results Persist in the Upcoming Quarter?

Over time, the mutual funds market has grown popularity as an investing option in India. They provide diversification, expert management, and the opportunity to increase wealth. However, a lot of investors have been worried about what they see to be “unfair performance” from market in recent quarters. These issues are…

The Chinese Dragon and Indian Bull: How China’s Stimulus Package Impacts Indian Markets

In recent times, two Asian titans – China and India – have come important players in the global economy. When China, known as the” dragon,” decides to fit plutocrat into its economy through encouragement packages, it sends ripples across global requests, including India’s, which is represented by the” bull.” India’s profitable growth is frequently likened to a bull request, charging forward with optimism. But with China’s new profitable measures, how will the Indian request respond? Let’s take a near look at this profitable face- off and what it could mean for investors, diligence, and consumers in India. COVID- 19 Aftermath Like utmost countries, China’s economy was affected by…

The 2024 US Presidential Election and Its Potential Impact on Indian Markets

The US presidential election in 2024 is drawing global attention, not only within America but also worldwide, including in India. As one of the largest and most diverse democracies, India closely follows US politics, especially when it comes to the economy. The US and India share strong trade and investment…

How Indian Millennials Are Embracing Mutual Funds for Long-Term Wealth

In the last decade, the financial landscape in India has witnessed a significant shift, with a growing number of millennials opting for mutual funds as a key investment vehicle for building long-term wealth. Unlike previous generations who were often content with saving in fixed deposits (FDs) or buying gold, today’s…

Myths About Mutual Funds Indian Investors Should Stop Believing

Mutual funds have become a popular investment choice for many Indians, but there are still several misconceptions surrounding them. These myths often discourage potential investors or lead them to make wrong decisions. It’s essential to debunk these myths and help people understand the reality so that they can make informed…

The Role of Mutual Funds in Achieving Short-term Financial Goals

In today’s fast-paced world, managing finances effectively is crucial for achieving financial stability and meeting short-term financial goals. Whether it’s saving for a vacation, planning a wedding, buying a car, or building an emergency fund, individuals are constantly looking for avenues that offer good returns with relatively low risk. One…

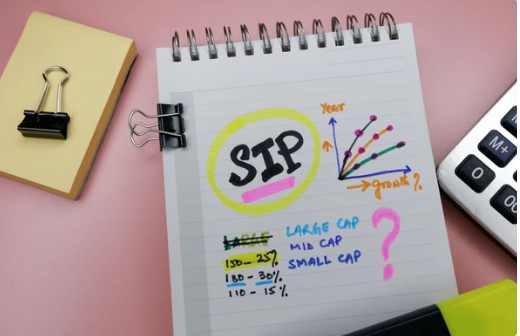

The Benefits of Starting a Systematic Investment Plan (SIP) Early

When it comes to building wealth over time, starting early is one of the most powerful strategies. In India, a Systematic Investment Plan (SIP) has become a popular tool for investing in mutual funds. An SIP allows you to invest a fixed amount regularly, usually monthly, into a mutual fund…

Systematic Investment Plan (SIP): How ₹500 a Month Can Grow Over Time

Investing can seem like a daunting task, especially if you’re just starting out with a small amount of money. But with a disciplined approach and the right strategy, even a modest amount, like ₹500 a month, can grow significantly over time. One of the most popular and effective ways to…

MUTUAL FUNDS INVESTING DURING MARKET VOLATILITY

Market volatility refers to the fluctuations in stock prices and other financial markets. It’s a common occurrence in India, especially in response to economic events, global news, or investor sentiment. While market volatility can be nerve-wracking for investors, it can also present opportunities. Mutual funds, which pool money from investors…

TAX-EFFICIENT MUTUAL FUNDS INVESTING

Investing in mutual funds has become a popular choice for many Indian investors, offering diversification, professional management, and the potential for higher returns. However, when building wealth, it’s not just about the returns; tax efficiency is equally important. Choosing the right tax-efficient mutual funds can help you maximize your investment…

Top Performing Mutual Funds in India: A Comprehensive Guide for 2024

.India’s mutual fund industry has witnessed remarkable growth in recent years, driven by an increasing awareness of investment opportunities and the potential for high returns. As of 2024, several mutual funds have emerged as top performers, reflecting their robust management strategies and the ability to navigate market volatility effectively. This…

Investing in Mutual Funds for Young Adults in India: A Beginner’s Guide

A Novice’s AideContributing can be a scary theme, particularly for youthful grown-ups simply beginning their monetary excursion. It’s easy to feel overwhelmed when there are so many choices. Be that as it may, shared reserves offer a basic, viable, and open way for youthful grown-ups in India to begin their…

The Impact of Government Policies on Mutual Funds in India

Introduction Mutual funds have become an integral part of the Indian financial landscape, providing a popular investment avenue for retail and institutional investors alike. The regulatory framework and government policies play a pivotal role in shaping the growth and development of the mutual fund industry. This blog explores the multifaceted…

Impact of global events on Indian Mutual Funds

Investing in mutual funds is a popular choice among Indian investors due to the diversification, professional management, and potential for attractive returns. However, like any other investment vehicle, mutual funds are not immune to the influences of global events. Understanding how these events impact Indian mutual funds can help investors…

New Mutual Funds launches and their potential

Introduction to Mutual Funds Mutual funds have become a popular investment vehicle in India, offering a diverse range of options for investors looking to grow their wealth. With the advent of new mutual funds, investors are presented with more opportunities to diversify their portfolios and capitalize on emerging market trends.…

Recent SEBI Regulations Impacting Mutual Funds in India 2024

In 2024, the Securities and Exchange Board of India (SEBI) introduced a series of regulations that have significantly impacted the mutual fund industry. These changes are designed to enhance transparency, ensure investor protection, and promote a more stable and investor-friendly market environment. Below, we discuss these key regulatory shifts and…

UNDERSTANDING MUTUAL FUNDS FACTSHEETS

stick to the top

THE ROLE OF FUND MANAGERS

Mutual funds have become a popular investment vehicle for many individuals looking to grow their wealth, and at the heart of every successful mutual fund is a skilled fund manager. The role of a fund manager is pivotal, not just in making investment decisions but in navigating market complexities to…

Mutual Funds vs. Other Investment Options

Investing is a crucial aspect of personal finance management. Whether you are a seasoned investor or just starting, understanding the various investment options available is vital to making informed decisions. Two popular choices among investors are mutual funds and other investment options such as stocks, bonds, real estate, and cryptocurrencies.…

Lessons Learned and Tips for Aspiring Mutual Fund Investors

Mutual funds are a popular investment vehicle that can help you achieve various financial goals, from saving for retirement to building wealth over time. In this guide, we will explore what mutual funds are, how they work, the different types available, and key considerations for investors. Investing in mutual funds…

DIFFERENT TYPES OF MUTUAL FUNDS AND THEIR MEANING.

Investing in mutual funds is a popular way for individuals to grow their wealth in India. With a variety of mutual funds available, it’s crucial to understand the different types and what they offer. This guide will break down the primary categories of mutual funds in India and their key…

HOW TO READ STOCK MARKET?

The stock market is a marketplace where investors buy and sell shares of publicly traded companies. It plays a crucial role in the economy by allowing companies to raise capital and providing investors with opportunities to own a portion of a company and potentially earn a return on their investment.…

Understanding the Latest Stock Market Trends in India

As we navigate through 2024, the Indian stock market continues to demonstrate its dynamic nature, influenced by a myriad of global and domestic factors. Here’s a deep dive into the latest trends shaping the Indian stock market and what investors need to keep an eye on. 1. Economic Revival and…

The Interplay of Elections and Market Dynamics in India

Elections in India are monumental events, characterized by vibrant political campaigns, intense public interest, and significant media coverage. Beyond their immediate political impact, elections also exert a profound influence on the country’s economic landscape. The Indian market, encompassing both the stock market and broader economic indicators, often responds dynamically to…

Financial Fitness: A Beginner’s Guide to Building Wealth

Whether you’re just starting out in your career or have a few years of work experience, taking control of your financial future can be both exciting and overwhelming. With the vast array of financial advice out there, it’s easy to feel confused about where to start. This guide aims to…

Recent Posts

- All Post

- Beginners News

- Financial

- Informative

- Insurance

- Mutual Fund

- SEBI

- Tax Planning

- Test

- TEST 1

- Back

- Budgeting

- Back

- ITR