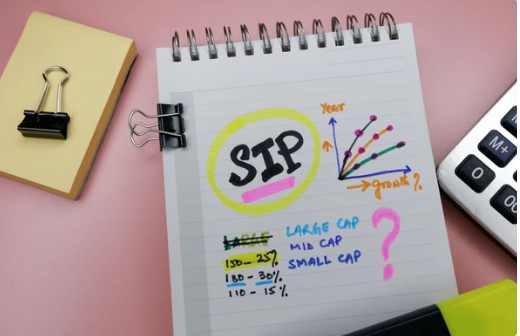

Investing can seem like a daunting task, especially if you’re just starting out with a small amount of money. But with a disciplined approach and the right strategy, even a modest amount, like ₹500 a month, can grow significantly over time. One of the most popular and effective ways to achieve this is through a Systematic Investment Plan (SIP).

A SIP is an investment method that allows you to invest a fixed sum of money at regular intervals (monthly, quarterly, etc.) in mutual funds. This article will explain how investing just ₹500 a month can grow over time, the key factors that influence growth, and why SIPs are a smart way to build wealth gradually.

1. The Power of Compounding

One of the most crucial aspects of SIP investments is the power of compounding. Compounding refers to the process where your returns start generating further returns. Essentially, you earn interest on both the original investment and the accumulated returns, leading to exponential growth over time.

For example, let’s say you invest ₹500 per month in a SIP. If the mutual fund offers an average annual return of 12%, your investment starts growing. In the first year, you’ll earn returns on your ₹500 monthly contribution, but by the second year, you’ll also earn returns on the interest accumulated during the first year. As this cycle continues, your investment grows faster and faster. This is the beauty of compounding – small, regular investments can lead to significant wealth creation over time.

Example:

- ₹500 per month for 1 year: ₹6,000 invested

- With an average return of 12%, after 10 years, this amount could grow to approximately ₹1 lakh.

- After 20 years, your ₹500 per month investment can grow to over ₹5 lakh.

2. Affordability and Flexibility

One of the key benefits of SIPs is their affordability. You don’t need a large sum of money to start investing. Even with as little as ₹500 a month, you can begin building your investment portfolio. This makes SIPs accessible to a wide range of people, including students, beginners, and those with limited disposable income.

Moreover, SIPs offer flexibility. You can increase the amount you invest as your income grows. For instance, if you start with ₹500 per month and, after a few years, increase it to ₹1,000 or more, your investments will grow even faster. Additionally, SIPs allow you to stop, increase, or decrease your investment amount anytime without penalties.

3. Rupee Cost Averaging

When you invest through SIPs, you benefit from a concept called Rupee Cost Averaging. This means that when markets are high, your ₹500 buys fewer units of a mutual fund, and when markets are low, the same ₹500 buys more units. Over time, this averaging effect helps to reduce the impact of market volatility on your investments. In other words, you don’t have to worry about trying to “time the market” or predict when it’s the best time to invest.

By consistently investing a fixed amount, you ensure that your investment grows steadily, irrespective of market ups and downs. This reduces the risk associated with investing large sums of money at once and helps you accumulate wealth gradually.

4. Discipline and Habit Formation

One of the best things about SIPs is that they encourage a disciplined approach to investing. Once you set up a SIP, the amount is automatically deducted from your bank account every month and invested in the mutual fund. This helps you stay consistent and avoid the temptation to skip investments, which is crucial for long-term wealth creation.

By making regular contributions through SIPs, you develop a habit of saving and investing. Over time, this habit can significantly impact your financial future. Even if you start with ₹500 a month, you’ll get into the mindset of investing regularly, and as your income increases, you can easily scale up your investments.

5. Long-Term Growth Potential

SIPs are designed for long-term wealth creation. The longer you stay invested, the more you benefit from compounding and rupee cost averaging. Historical data shows that equity mutual funds, when invested in for the long term, have provided an average annual return of 10-15%.

Although markets may fluctuate in the short term, over a longer period (10, 20, or even 30 years), they tend to rise. Therefore, if you start investing ₹500 per month in a SIP at a young age, your investment has decades to grow. Even if you don’t increase your monthly contribution, a long-term investment horizon can turn a small amount into a large corpus.

Example:

If you invest ₹500 a month in a mutual fund offering a 12% average annual return:

- After 10 years, your total investment of ₹60,000 can grow to over ₹1 lakh.

- After 20 years, your total investment of ₹1.2 lakh can grow to over ₹5 lakh.

- After 30 years, your total investment of ₹1.8 lakh can grow to over ₹18 lakh.

6. Low Risk for Beginners

For new investors, SIPs are an ideal way to enter the world of investing because they involve less risk compared to lump-sum investments. By spreading your investment over time, SIPs help reduce the impact of market fluctuations. Moreover, since you invest small amounts at regular intervals, the risk of losing a significant portion of your money due to market downturns is minimized.

For someone investing ₹500 per month, the potential losses during a market downturn are much smaller compared to those investing a large lump sum. This makes SIPs a relatively safer option for beginners who may be unfamiliar with the complexities of the stock market.

7. Diversification and Professional Management

When you invest through a SIP in mutual funds, your money is managed by professional fund managers. These experts analyze the market and make investment decisions on your behalf, ensuring your money is allocated across a diverse range of assets, such as stocks, bonds, and other securities. This diversification reduces the overall risk of your investment, as losses in one area can be offset by gains in another.

By investing ₹500 per month through a SIP, you gain access to a professionally managed, diversified portfolio that would be difficult to build on your own with such a small amount.

8. Tax Benefits

Certain types of mutual funds, such as Equity Linked Savings Schemes (ELSS), offer tax benefits under Section 80C of the Income Tax Act. If you invest in ELSS through SIPs, not only can your ₹500 per month grow over time, but you can also reduce your taxable income and save on taxes. This makes SIPs an even more attractive investment option for long-term financial planning.

Conclusion

In conclusion, investing ₹500 a month through a SIP may seem like a small amount, but over time, it can grow into a significant corpus due to the power of compounding, rupee cost averaging, and disciplined investing. SIPs offer flexibility, affordability, and professional management, making them an ideal investment option for beginners and seasoned investors alike.

By starting small and staying consistent, you can achieve your financial goals and build wealth gradually. The key is to start early, be patient, and let time and the market work in your favor. Whether you’re saving for retirement, your child’s education, or a major life event, a ₹500 SIP can be the first step toward achieving financial independence.

Frequently Asked Questions (FAQs)

1. Can ₹500 a month really make a difference in the long term?

Yes, absolutely! Although ₹500 may seem like a small amount, the key to wealth creation through SIP is consistency and time. With the power of compounding, even a small monthly investment can grow significantly over 10, 20, or 30 years. For example, investing ₹500 per month at an average return rate of 12% can turn into over ₹18 lakh in 30 years. The longer you stay invested, the more your money grows.

2. What happens if I miss a SIP payment?

If you miss a SIP payment due to insufficient funds or any other reason, the mutual fund will not impose any penalties, and your investment won’t be canceled. However, it’s important to maintain a disciplined approach to maximize the benefits of regular investing. Most mutual funds allow you to restart the SIP once you’re ready, but staying consistent is ideal for long-term growth.

3. Can I increase my SIP amount over time?

Yes, you can increase your SIP amount whenever you wish. Many investors start with ₹500 and gradually increase the amount as their income grows. This strategy, known as “step-up SIP,” helps to build wealth faster and ensures that you invest more as your financial capacity increases. You can do this by simply instructing your mutual fund provider to modify your SIP contributions.